梦想-电信行业是如何颠覆印度娱乐业的?

高速增长的数字消费的下一个阶段,很可能是由农村地区和区域市场的电信运营商带来的。

高速增长的数字消费的下一个阶段,很可能是由农村地区和区域市场的电信运营商带来的。

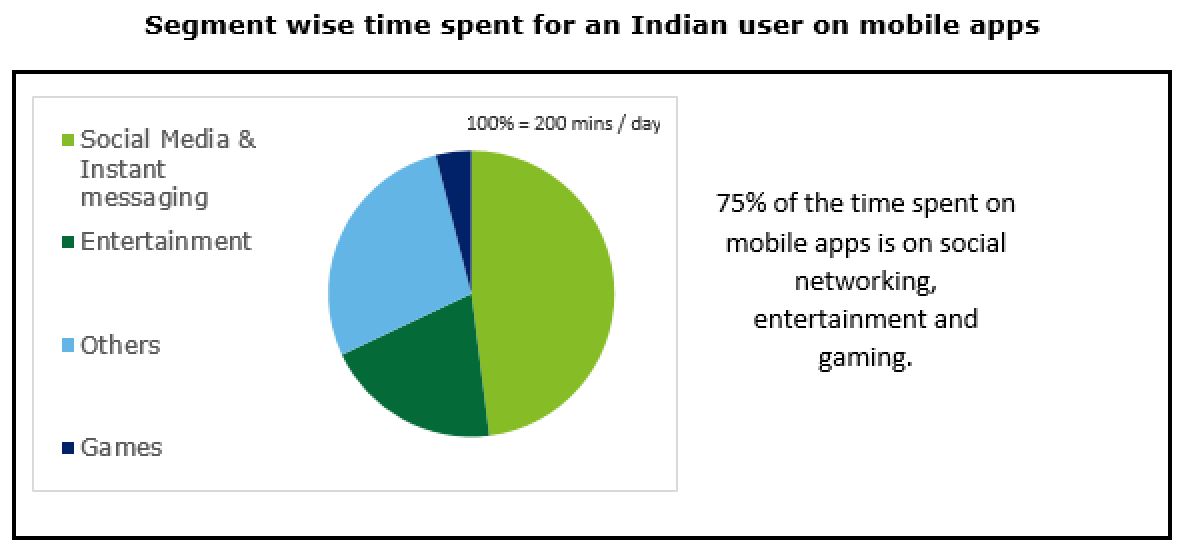

India reached a wireless telecom subscriber base of 1.18 billion in March 2018. The mobile phone has now become the primary mode of social networking, news and entertainment. With India being the second largest market for smartphones globally and with the increasing adoption of 3G and 4G, India is estimated to have 500 million internet users by June 2018 constituting to around 37% of the total population. India is still at a nascent stage of telecom penetration when compared to mature markets such as Japan, UK, South Korea and Netherlands where internet penetration stands at >90%. Further the average usage of content in India on mobile apps is around 200 minutes a day as shown in the buckets in the pie chart below. This consumption duration is still lower than consumption in various countries thus indicating that the Indian landscape has a significant opportunity ahead.<\/p>

The next leg of high growth digital consumption, is likely to be brought about by telecom operators in rural areas and in the regional markets. By 2021, around 70% consumption is estimated to be in Hindi and other Indian regional languages. Further, India is expected to have over 700 million users from non-metro cities and the number of rural internet users would have overtaken urban users by 2021. With high penetration levels that the telecom operators offer, coupled with the ability to deliver hyper customized content in customer\u2019s choice of language across urban and rural areas,telecom operators are in the driver\u2019s seat to capture and engage the large the number of untapped potential Indian internet users.<\/p>

Telecom companies will not only enable increased consumption but also bring out new customer segmentations. Three clear and distinct consumer segments may emerge \u2013 the mass consumers consuming TV (Free and Pay TV) and Free OTT, the tactical consumers consuming Pay TV and Pay OTT and finally a sizeable number of digital-only consumers. This segmentation is on the basis of consumers\u2019 ability and willingness to pay for content, enabled by the digital micro-payments ecosystem. By 2020, the digital only subscribers segment could touch 4 million. This presents a great opportunity to the telecom operators.<\/p>

With the high rise in consumption in digital media, the partnership between telecom operators and content providers is getting stronger than ever. We are witnessing a variety of partnerships between telecom operators and media companies in the market. A prime example of this would be the recently concluded high profile Vivo IPL 2018 that was offered to subscribers of Airtel and Jio on their platforms at no additional cost for viewing content. Vivo IPL was expected to have over 700 million watching the event. Telecom operators have also started inking exclusive content deals. Airtel and ALTBalaji joined hands to offer exclusive digital content in March 2018. Jio signed deals with Roy Kapur Films, Saavn, and has also acquired 24.92% stake in Bajali Telefilms and 5% equity stake in Eros International Plc. Vodafone India offers free subscriptions ofNetflixand Magzter to customers of its \u2018RED\u2019 plans and Idea Cellular has a partnership with Magzter to offer Idea users access to digital magazines and news. These offerings are further to an option of viewing TV content through their Apps.<\/p>

<\/p>

<\/p>

<\/p>

There are a few trends that are catching up and will play a significant role in the near future. The interactivity feature is one such that enables the use of a second screen, typically the mobile phone, while viewing content on TV. Broadcasters such as Colors and Sony and OTT players such as Hotstar have implemented this thus far. Few other important trends worthwhile to note would be the advent of e-sports, which is presently nascent but is expected to grow fivefold in India over the next five years, and Edu-tainment which is expected to reach a market size of $5.7 billion by 2020. We have been seeing major shifts with the use of AR and VR too, currently in the nascent stage, but is expected to grow at 76% CAGR over the next five years.<\/p>

A natural step forward from hereon for the telecom operators would be to dive into content creation which will aid engagement on their platforms and apps, thereby ensuring presence across the value chain from content creation, to distribution and consumption through the network.<\/p>

Further, the telecom operators\u2019 choice of markets will need to be strategic with a host of decisions on language of content and its genre. This accompanied with certain carefully thought out marketing and pricing strategies keeping in view the diversity of the Indian consumer base.<\/p>

To conclude, India is at a cusp of a digital consumption breakout with exceptionally high levels of demand. Telecom operators are best placed to reap maximum benefits through this phenomenon by offering a 360\u00b0solution to consumers and by being present across the value chain.<\/p>","blog_img":"retail_files\/blog_1528779768_temp.jpg","posted_date":"2018-06-08 12:28:47","modified_date":"2018-06-12 10:32:48","featured":"0","status":"Y","seo_title":"Piped dreams - How telecom sector is disrupting Indian entertainment industry?","seo_url":"piped-dreams-how-telecom-sector-is-disrupting-indian-entertainment-industry","url":"\/\/www.iser-br.com\/tele-talk\/piped-dreams-how-telecom-sector-is-disrupting-indian-entertainment-industry\/3077","url_seo":"piped-dreams-how-telecom-sector-is-disrupting-indian-entertainment-industry"}">

印度文化的演变电信行业是否能够获得更高的平均水平互联网速度为每秒9 MB4 g网络从2013年的每秒1.5 MB。4.12亿用户已接入宽带连接(> 512kbps下载)。高速互联网的容易获得不仅增加了在线内容消费的时间,而且还为印度用户提供了全球内容。随着电信消费从语音转向数据,电信运营商正准备通过数字经济的新口号——“内容”来满足消费者日益增长的需求。无论是体育、新闻、音乐还是电乐动扑克影,电信公司都在迅速整合自己,成为新兴的印度媒体行业的一部分。

2018年3月,印度无线电信用户数量达到11.8亿。手机现在已经成为社交网络、新闻和娱乐的主要方式。乐动扑克印度是全球第二大智能手机市场,随着3G和4G的普及,预计到2018年6月,印度将拥有5亿互联网用户,占总人口的37%左右。与日本、英国、韩国和荷兰等成熟市场相比,印度仍处于电信渗透率的初级阶段,这些市场的互联网渗透率达到了90%。此外,印度移动应用程序的平均内容使用量约为每天200分钟,如下面的饼状图中的桶所示。这一消费持续时间仍低于其他国家的消费,因此表明印度前景有重大机遇。

高速增长的数字消费的下一个阶段,很可能是由农村地区和区域市场的电信运营商带来的。到2021年,预计约70%的消费是印地语和其他印度地区语言。此外,到2021年,印度非大都市城市的互联网用户预计将超过7亿,农村互联网用户数量将超过城市用户。由于电信运营商提供的高普及率,再加上能够在城市和农村地区以客户选择的语言提供超级定制的内容,电信运营商在捕捉和吸引大量未开发的潜在印度互联网用户方面处于主导地位。

电信公司不仅会增加消费,还会带来新的客户细分。可能会出现三个明确而独特的消费者群体——消费电视(免费和付费电视)和免费OTT的大众消费者,消费付费电视和付费OTT的战术消费者,以及数量可观的纯数字消费者。这种细分是基于消费者为内容付费的能力和意愿,由数字小额支付生态系统实现。到2020年,纯数字用户将达到400万。这对电信运营商来说是一个巨大的机遇。

随着数字媒体消费的大幅增长,电信运营商和内容提供商之间的合作关系比以往任何时候都更加紧密。我们正在见证电信运营商和媒体公司在市场上的各种合作关系。这方面的一个主要例子是最近结束的高调Vivo IPL 2018附近的旅馆和Jio在他们的平台上,观看内容无需额外付费。Vivo IPL预计将有超过7亿人观看比赛。电信运营商也开始签订独家内容协议。Airtel和ALTBalaji于2018年3月联手提供独家数字内容。Jio与Roy Kapur Films, Saavn签署了协议,还收购了Bajali teleffilms 24.92%的股份和Eros 5%的股权国际Plc。沃达丰印度为其“RED”计划的客户提供免费订阅netflix和Magzter知道细胞与Magzter合作,为Idea用户提供数字杂志和新闻。乐动扑克这些产品进一步提供了通过其应用程序观看电视内容的选项。

有一些趋势它们正在迎头赶上,并将在不久的将来发挥重要作用。交互功能是指在观看电视内容时可以使用第二个屏幕,通常是移动电话。到目前为止,Colors和Sony等广播公司以及Hotstar等OTT播放器已经实现了这一功能。其他值得注意的重要趋势是电子竞技的出现,目前它还处于萌芽阶段,但预计在未来五年内将在印度增长五倍,而教育娱乐预计到2020年将达到57亿美元的市场规模。我们也看到了AR和VR应用的重大变化,目前还处于萌芽阶段,但预计未来五年的复合年增长率将达到76%。

对于电信运营商来说,从现在开始向前迈出的自然一步是深入内容创作,这将有助于他们在平台和应用程序上的粘性,从而确保在整个价值链上的存在,从内容创作,到通过网络分发和消费。

此外,电信运营商对市场的选择将需要在内容语言和类型方面做出一系列战略决策。与此同时,考虑到印度消费者群体的多样性,我们还制定了一些经过深思熟虑的营销和定价策略。

总之,印度正处于数字消费爆发的风口浪尖,需求水平异常高。电信运营商通过向消费者提供360°解决方案,并在整个价值链上存在,最适合从这一现象中获得最大利益。

免责声明:所表达的观点仅代表作者,ETTelecom.com并不一定订阅它。乐动体育1002乐动体育乐动娱乐招聘乐动娱乐招聘乐动体育1002乐动体育etelecom.com不对直接或间接对任何人/组织造成的任何损害负责。

India reached a wireless telecom subscriber base of 1.18 billion in March 2018. The mobile phone has now become the primary mode of social networking, news and entertainment. With India being the second largest market for smartphones globally and with the increasing adoption of 3G and 4G, India is estimated to have 500 million internet users by June 2018 constituting to around 37% of the total population. India is still at a nascent stage of telecom penetration when compared to mature markets such as Japan, UK, South Korea and Netherlands where internet penetration stands at >90%. Further the average usage of content in India on mobile apps is around 200 minutes a day as shown in the buckets in the pie chart below. This consumption duration is still lower than consumption in various countries thus indicating that the Indian landscape has a significant opportunity ahead.<\/p>

The next leg of high growth digital consumption, is likely to be brought about by telecom operators in rural areas and in the regional markets. By 2021, around 70% consumption is estimated to be in Hindi and other Indian regional languages. Further, India is expected to have over 700 million users from non-metro cities and the number of rural internet users would have overtaken urban users by 2021. With high penetration levels that the telecom operators offer, coupled with the ability to deliver hyper customized content in customer\u2019s choice of language across urban and rural areas,telecom operators are in the driver\u2019s seat to capture and engage the large the number of untapped potential Indian internet users.<\/p>

Telecom companies will not only enable increased consumption but also bring out new customer segmentations. Three clear and distinct consumer segments may emerge \u2013 the mass consumers consuming TV (Free and Pay TV) and Free OTT, the tactical consumers consuming Pay TV and Pay OTT and finally a sizeable number of digital-only consumers. This segmentation is on the basis of consumers\u2019 ability and willingness to pay for content, enabled by the digital micro-payments ecosystem. By 2020, the digital only subscribers segment could touch 4 million. This presents a great opportunity to the telecom operators.<\/p>

With the high rise in consumption in digital media, the partnership between telecom operators and content providers is getting stronger than ever. We are witnessing a variety of partnerships between telecom operators and media companies in the market. A prime example of this would be the recently concluded high profile Vivo IPL 2018 that was offered to subscribers of Airtel and Jio on their platforms at no additional cost for viewing content. Vivo IPL was expected to have over 700 million watching the event. Telecom operators have also started inking exclusive content deals. Airtel and ALTBalaji joined hands to offer exclusive digital content in March 2018. Jio signed deals with Roy Kapur Films, Saavn, and has also acquired 24.92% stake in Bajali Telefilms and 5% equity stake in Eros International Plc. Vodafone India offers free subscriptions ofNetflixand Magzter to customers of its \u2018RED\u2019 plans and Idea Cellular has a partnership with Magzter to offer Idea users access to digital magazines and news. These offerings are further to an option of viewing TV content through their Apps.<\/p>

<\/p>

<\/p>

<\/p>

There are a few trends that are catching up and will play a significant role in the near future. The interactivity feature is one such that enables the use of a second screen, typically the mobile phone, while viewing content on TV. Broadcasters such as Colors and Sony and OTT players such as Hotstar have implemented this thus far. Few other important trends worthwhile to note would be the advent of e-sports, which is presently nascent but is expected to grow fivefold in India over the next five years, and Edu-tainment which is expected to reach a market size of $5.7 billion by 2020. We have been seeing major shifts with the use of AR and VR too, currently in the nascent stage, but is expected to grow at 76% CAGR over the next five years.<\/p>

A natural step forward from hereon for the telecom operators would be to dive into content creation which will aid engagement on their platforms and apps, thereby ensuring presence across the value chain from content creation, to distribution and consumption through the network.<\/p>

Further, the telecom operators\u2019 choice of markets will need to be strategic with a host of decisions on language of content and its genre. This accompanied with certain carefully thought out marketing and pricing strategies keeping in view the diversity of the Indian consumer base.<\/p>

To conclude, India is at a cusp of a digital consumption breakout with exceptionally high levels of demand. Telecom operators are best placed to reap maximum benefits through this phenomenon by offering a 360\u00b0solution to consumers and by being present across the value chain.<\/p>","blog_img":"retail_files\/blog_1528779768_temp.jpg","posted_date":"2018-06-08 12:28:47","modified_date":"2018-06-12 10:32:48","featured":"0","status":"Y","seo_title":"Piped dreams - How telecom sector is disrupting Indian entertainment industry?","seo_url":"piped-dreams-how-telecom-sector-is-disrupting-indian-entertainment-industry","url":"\/\/www.iser-br.com\/tele-talk\/piped-dreams-how-telecom-sector-is-disrupting-indian-entertainment-industry\/3077","url_seo":"piped-dreams-how-telecom-sector-is-disrupting-indian-entertainment-industry"},img_object:["retail_files/blog_1528779768_temp.jpg","retail_files/author_1528369597_temp.jpg"],fromNewsletter:"",newsletterDate:"",ajaxParams:{action:"get_more_blogs"},pageTrackingKey:"Blog",author_list:"Prashanth Rao",complete_cat_name:"Blogs"});" data-jsinvoker_init="_override_history_url = "//www.iser-br.com/tele-talk/piped-dreams-how-telecom-sector-is-disrupting-indian-entertainment-industry/3077";">