家庭宽带:开启印度电信公司下一个收入引擎的关键

“考虑到目前的ARPU水平,并考虑到家庭收入的分裂,印度至少应该有5000万家庭应该成为家庭宽带解决方案的目标(是目前拥有固定宽带连接的2000万家庭的两倍多)。”

“考虑到目前的ARPU水平,并考虑到家庭收入的分裂,印度至少应该有5000万家庭应该成为家庭宽带解决方案的目标(是目前拥有固定宽带连接的2000万家庭的两倍多)。”

Markets where smart TV and smartphones penetration is already high, have now started to move towards delivering service promise that cannot be matched by mobile offerings. Telcos in countries such as UK and Australia have started to offer varieties of \u201cspeed promise\u201d, \u201cmoney back if no service\u201d guarantees to customers. These guarantees provide clearly differentiated experience (against mobile broadband) and gives a very compelling reason for customers to adopt home broadband solutions. <\/p>","blog_img":"retail_files\/blog_1606373763_temp.jpg","posted_date":"2020-11-26 12:26:04","modified_date":"2020-11-26 12:49:06","featured":"0","status":"Y","seo_title":"The key to unlocking the next revenue engine for Indian telecoms may well lie in unlocking","seo_url":"the-key-to-unlocking-the-next-revenue-engine-for-indian-telecoms-may-well-lie-in-unlocking-homes","url":"\/\/www.iser-br.com\/tele-talk\/the-key-to-unlocking-the-next-revenue-engine-for-indian-telecoms-may-well-lie-in-unlocking-homes\/4644","url_seo":"the-key-to-unlocking-the-next-revenue-engine-for-indian-telecoms-may-well-lie-in-unlocking-homes"}">

在2019年6月至2020年6月期间增加了约10万名客户后,一家领先的印度电信公司增加了约13万名客户宽带仅在截至2020年9月的季度,客户数量就超过了前四个季度的累计客户数量。此外,虽然资本支出占销售额的比例徘徊在20%左右,但在截至2020年9月的季度,这一比例上升到53%。 智能电视和智能手机的市场渗透率已经很高,现在已经开始向提供移动产品无法匹敌的服务承诺迈进。英国和澳大利亚等国的电信公司已开始向客户提供各种各样的“速度承诺”,“如果没有服务就退款”的保证。这些保证提供了明显不同的体验(相对于移动宽带),并为客户采用家庭宽带解决方案提供了非常有说服力的理由。 免责声明:所表达的观点仅代表作者,ETTelecom.com并不一定订阅它。乐动体育1002乐动体育乐动娱乐招聘乐动娱乐招聘乐动体育1002乐动体育etelecom.com不对直接或间接对任何人/组织造成的任何损害负责。

Using alternative technologies to accelerate faster rollout to home broadband offerings:<\/strong>

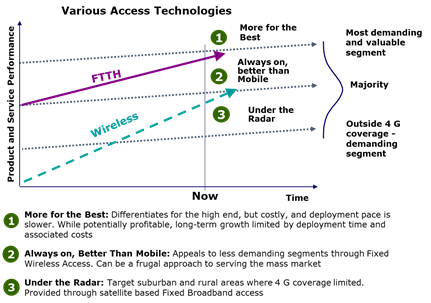

While fixed broadband has remained the de-facto solution for providing always on, high speed home broadband connection, wireless and satellite-based technologies have also made rapid progress in the last few years. From offerings speeds ~ 10 Mbps till about 2015, wireless technologies today can deliver > 200 Mbps. Markets such as US, Australia and closer home in Philippines have seen telcos use Fixed Wireless Access technologies to rapidly expand home broadband services. A leading telco in the Philipines for example has added ~ 1.4 million customers in the period from January to Septempber 2020, in a country with just 25 million households.

Rural broadband penetration in India is still only 30% (TRAI Performance Indicators report, FY 2019\u201320 Q3). Satellite based technologies provide an excellent alternative to providing effective solutions for these and suburban markets where the 4G coverage isn\u2019t good enough and fixed broadband is not feasible to rollout.

Spend on communication services is typically 3% of household income. Given the current ARPU levels, and considering the household breakup by income, there should be atleast 50 million households in India who should be targetable for home broadband solutions (more than double of the current 20 million households that have fixed broadband connections).<\/p>

原因是可以理解的。COVID已成为印度和其他市场对家庭宽带需求增加的催化剂。根据德勤的消费者信心调查,70%的参与者认为他们将更经常在家工作,84%的人准备支付额外费用以提高宽带速度,但很少有(34%)的人只依赖移动设备来使用家庭互联网。这些消费者中的大多数还认为,这种趋势将在未来继续下去,并放大对家庭宽带的需求比以往任何时候都多。最近允许员工在家工作的规定可能会进一步推动这一增长。

印度目前的固定宽带普及率仅为7.6%,是亚洲新兴国家中最低的。相比之下,印尼(15%)、菲律宾(18%)、马来西亚(41%)、泰国和越南的渗透率接近50%。尽管印度的宽带ARPU为11美元,低于这些国家,但印度尼西亚(16美元)、菲律宾(25美元)、马来西亚(32美元)、泰国(17美元)和越南(16美元)都更高。在这些国家中,印度的真正无限家庭宽带计划也是最低的,每月5.3美元。

所有这些都显示出印度的巨大潜力。然而,有两个领域是印度家庭宽带增长的高优先级:

(一)使家庭宽带更受欢迎(价格已经确定,需要推动客户对家庭宽带解决方案的吸引力);

(b)开发替代技术选项,更快地部署家庭宽带解决方案。

推动家庭宽带的吸引力不仅仅是快速互联网:

按火车印度的宽带下载速度为38.19 Mbps,在175个国家中排名第75位。在金砖国家中,巴西(59.4 Mbps)、俄罗斯(68.4 Mbps)、中国(133.6 Mbps)都提供了更高的网速,只有南非(36.3 Mbps)略慢于印度。

虽然印度确实必须赶上提供更快的速度,但看看其他市场,就能了解市场将如何发展。在全球范围内,从服务提供的角度来看,市场可以分为三大类:(a)主要用于高速,始终在线的家庭宽带,(b)也用于娱乐,生产力(学习,医疗等)和安全中心,(c)差异化体验。

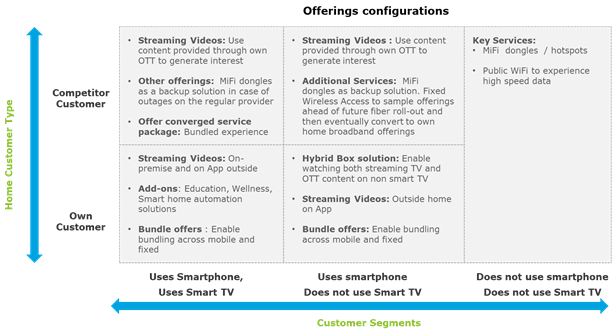

在2.7亿多家庭中,印度约有2亿电视家庭和7000万DTH客户。媒体和娱乐是印度的一大驱动力。我们还有超过650个移动宽带用户。智能电视是增长最快的耐用消费品之一,因此,同时拥有智能手机和智能电视的家庭将越来越多。因此,预计印度的服务产品将开始效仿一些更发达的市场:

使用替代技术加速家庭宽带产品的快速推出:

虽然固定宽带仍然是提供始终在线的实际解决方案,但高速家庭宽带连接、无线和基于卫星的技术在过去几年也取得了快速进展。从提供的速度~ 10 Mbps到大约2015年,今天的无线技术可以提供> 200 Mbps。在美国、澳大利亚和菲律宾等市场,电信公司已经使用固定无线接入技术迅速扩展家庭宽带服务。例如,菲律宾一家领先的电信公司在2020年1月至9月期间增加了约140万客户,而该国只有2500万户家庭。

农村宽带印度的渗透率仍然只有30% (TRAI绩效指标报告,2019-20财年第三季度)。基于卫星的技术提供了一个很好的替代方案,为这些和郊区市场提供有效的解决方案4 g覆盖不够好,固定宽带不可行。

用于通信服务的支出通常占家庭收入的3%。考虑到目前的ARPU水平,并考虑到按收入划分的家庭,印度至少应该有5000万家庭应该成为家庭宽带解决方案的目标(是目前拥有固定宽带连接的2000万家庭的两倍多)。

Markets where smart TV and smartphones penetration is already high, have now started to move towards delivering service promise that cannot be matched by mobile offerings. Telcos in countries such as UK and Australia have started to offer varieties of \u201cspeed promise\u201d, \u201cmoney back if no service\u201d guarantees to customers. These guarantees provide clearly differentiated experience (against mobile broadband) and gives a very compelling reason for customers to adopt home broadband solutions. <\/p>","blog_img":"retail_files\/blog_1606373763_temp.jpg","posted_date":"2020-11-26 12:26:04","modified_date":"2020-11-26 12:49:06","featured":"0","status":"Y","seo_title":"The key to unlocking the next revenue engine for Indian telecoms may well lie in unlocking","seo_url":"the-key-to-unlocking-the-next-revenue-engine-for-indian-telecoms-may-well-lie-in-unlocking-homes","url":"\/\/www.iser-br.com\/tele-talk\/the-key-to-unlocking-the-next-revenue-engine-for-indian-telecoms-may-well-lie-in-unlocking-homes\/4644","url_seo":"the-key-to-unlocking-the-next-revenue-engine-for-indian-telecoms-may-well-lie-in-unlocking-homes"},img_object:["retail_files/blog_1606373763_temp.jpg","retail_files/author_1606373196_16629.jpg"],fromNewsletter:"",newsletterDate:"",ajaxParams:{action:"get_more_blogs"},pageTrackingKey:"Blog",author_list:"Sagar Darbari",complete_cat_name:"Blogs"});" data-jsinvoker_init="_override_history_url = "//www.iser-br.com/tele-talk/the-key-to-unlocking-the-next-revenue-engine-for-indian-telecoms-may-well-lie-in-unlocking-homes/4644";">

Using alternative technologies to accelerate faster rollout to home broadband offerings:<\/strong>

While fixed broadband has remained the de-facto solution for providing always on, high speed home broadband connection, wireless and satellite-based technologies have also made rapid progress in the last few years. From offerings speeds ~ 10 Mbps till about 2015, wireless technologies today can deliver > 200 Mbps. Markets such as US, Australia and closer home in Philippines have seen telcos use Fixed Wireless Access technologies to rapidly expand home broadband services. A leading telco in the Philipines for example has added ~ 1.4 million customers in the period from January to Septempber 2020, in a country with just 25 million households.

Rural broadband penetration in India is still only 30% (TRAI Performance Indicators report, FY 2019\u201320 Q3). Satellite based technologies provide an excellent alternative to providing effective solutions for these and suburban markets where the 4G coverage isn\u2019t good enough and fixed broadband is not feasible to rollout.

Spend on communication services is typically 3% of household income. Given the current ARPU levels, and considering the household breakup by income, there should be atleast 50 million households in India who should be targetable for home broadband solutions (more than double of the current 20 million households that have fixed broadband connections).<\/p>